What is a cap rate?

Capitalization (cap) rate is a valuable tool to compare multiple income/investment properties for the investor. The formula is defined as:

cap rate = net operating income (NOI)

current price

In general, a property with a higher cap rate is a better deal, assuming the subject property doesn’t have significant deferred maintenance

or is in need of expensive repairs.

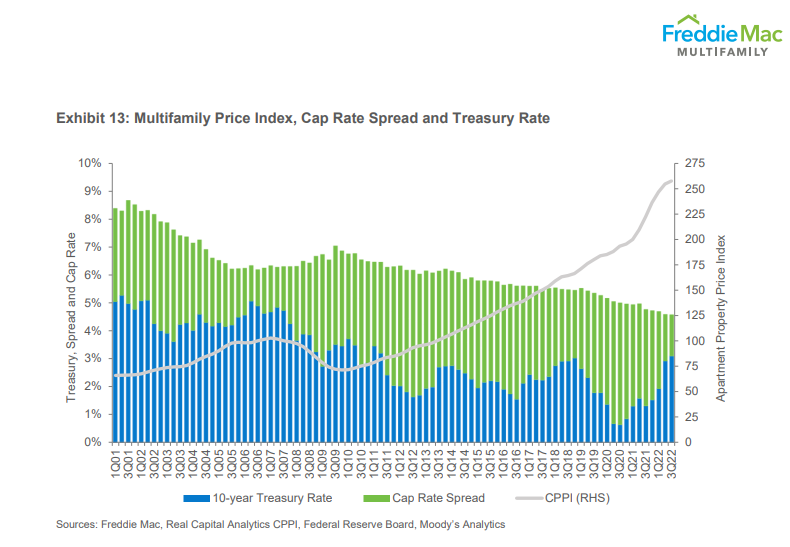

In looking at the Q1 & Q3 2022 multi-family (apartments) cap rate spread, graphed with the 10-year treasury yield from Freddic Mac,

the cap rates are actually lower than what you’d expect an investor would have to pay for a commercial loan. In this example, multi-family properties

are expensive (low cap rate) therefore not as good of a deal during that time period.