Which is a better investment: STR vs. LTR?

In our diversified real estate portfolio, when it comes to single family homes, is short term rentals (STR) or long term rentals (LTR) a better strategy?

Let’s take a look at how our (2) such properties fared between 2019 through 2022:

Short term rental: 4BR/3BA, 2,450sf, Movie Colony East of Palm Springs, purchased June 2019 @ $680K

Long term renta; 4BR/3.5BA, 2,852sf, 900sf of it is a separate 1BR/1BA cottage, Pleasant Hill, purchased Nov 2000 @ $690K

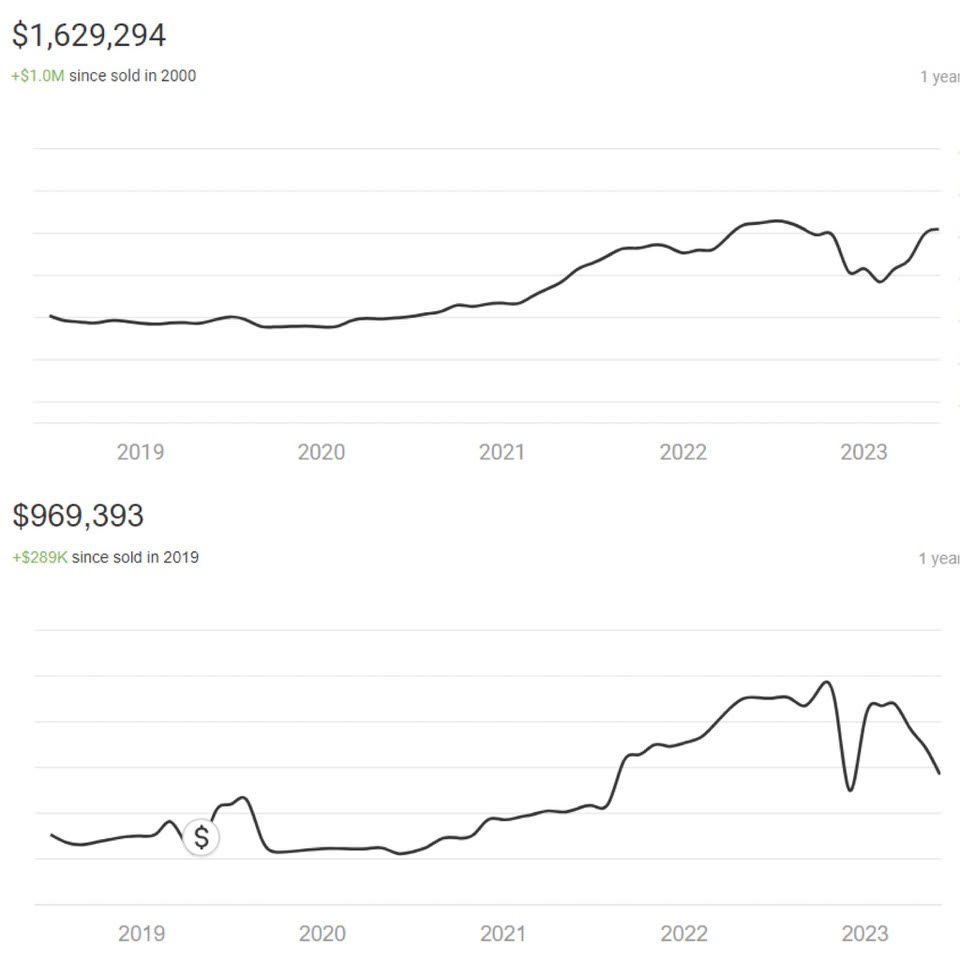

Insert attached graph here

Appreciation between 2019 and 2023

Palm Springs ($680K to $1.27m, using Redfin estimates. Ignore the erratic drop in value in 2023

29% each year

Pleasant Hill ($1.2m to $1.63m, using Redfin estimates)

12% each year

Income (income net expenses, excl loan payments)

2020 2021 2022

P Hill $58K $57K $66K

P Springs $43K* $79K $70K

*shelf-in-place resulted in 3 months of cancelled Airbnb bookings

Conclusion: short term rental incomes are more volatile but higher and the property appreciates faster due to investor demand.